Collecting points is a lifestyle for many. Getting great deals on flights, for example, by carefully collecting and spending points can make the difference between slumming it in cattle class or living it up, pinky-out, in great luxury up front.

Last year, we covered real-time flight rewards search engine point.me’s $2 million round, and at the beginning of this month, the company raised an additional $10 million. Today I’m putting the deck that the company used to raise its new round under the loupe to find out if the startup missed the point(s) or if it’s soaring to great heights.

When I found out what the company does, I was immediately curious how it was going to tell its story in a way that inspires urgency. I like a good airline points flight just as much as the fuzzy feeling you get from knowing you’ve “beaten the system,” but is this a product that solves a “real” problem? Or is it a disposable luxury good? Let’s dive in and find out.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

Point.me used a 16-slide deck to raise its $10 million:

- Cover slide

- Problem slide

- Problem impact slide

- “How it’s currently solved” slide

- Solution slide

- Value proposition slide

- Product benefits slide

- Product slide

- Product delivery slide

- Product screenshots slide

- Traction slide

- Press clippings slide

- Moat slide

- Team slide

- Past investors slide

- Closing slide

Three things to love

Point.me gets a lot of things right in this deck. It’s obvious that it has honed its customer messaging a lot over its existence.

Great consumer-focused messaging

As you can see from the “slides in this deck” overview, point.me spends quite a bit of time on the product. That’s often a cranberry-colored flag in my book, but I can’t really fault it thatmuch. The company did get me curious enough to go check out its pricing page, which means they almost had me.

Techcrunch eventJoin 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Sequoia Capital, Elad Gil — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before Sept 26 to save up to $668.

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Sequoia Capital, Elad Gil — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before Sept 26 to save up to $668.

San Francisco | October 27-29, 2025 REGISTER NOWSome hard-hitting facts

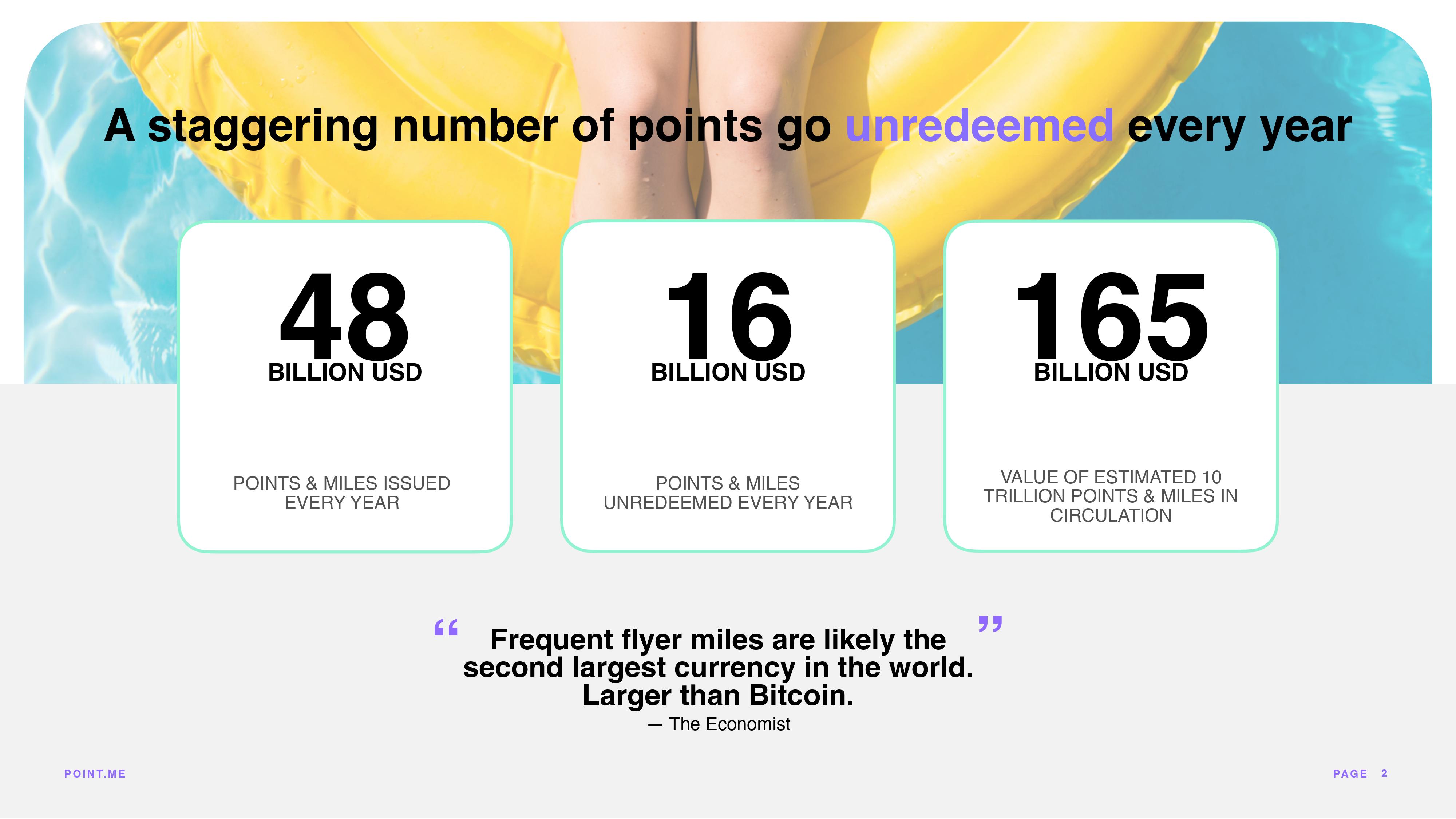

This slide is really interesting for a number of reasons. For one, I had no idea how big the airline points economy was, nor what a fantastic tool it is for airlines. Issuing $48 billion worth of points and then having a third of them go unredeemed is a hell of a business model. It only gets worse: The founders tell me that these numbers were correct when they went to raise money last time, but they claim that the value of unredeemed points and miles per year is now closer to $30 billion, not $16 billion.

Of course, this is built into the airline card models. It’s very cheap to issue points if you know that many of them won’t be redeemed, especiallyif those points eventually expire.

The economist in me sees this as a risk to point.me, however: It’s a dangerous place to operate in. The more successful you get, the more incentive there is for the people whose product you are augmenting to shut you down or at least make your life harder.

Build a company, not a feature

Still, if you’re making hay while the sun shines, this seems pretty compelling.

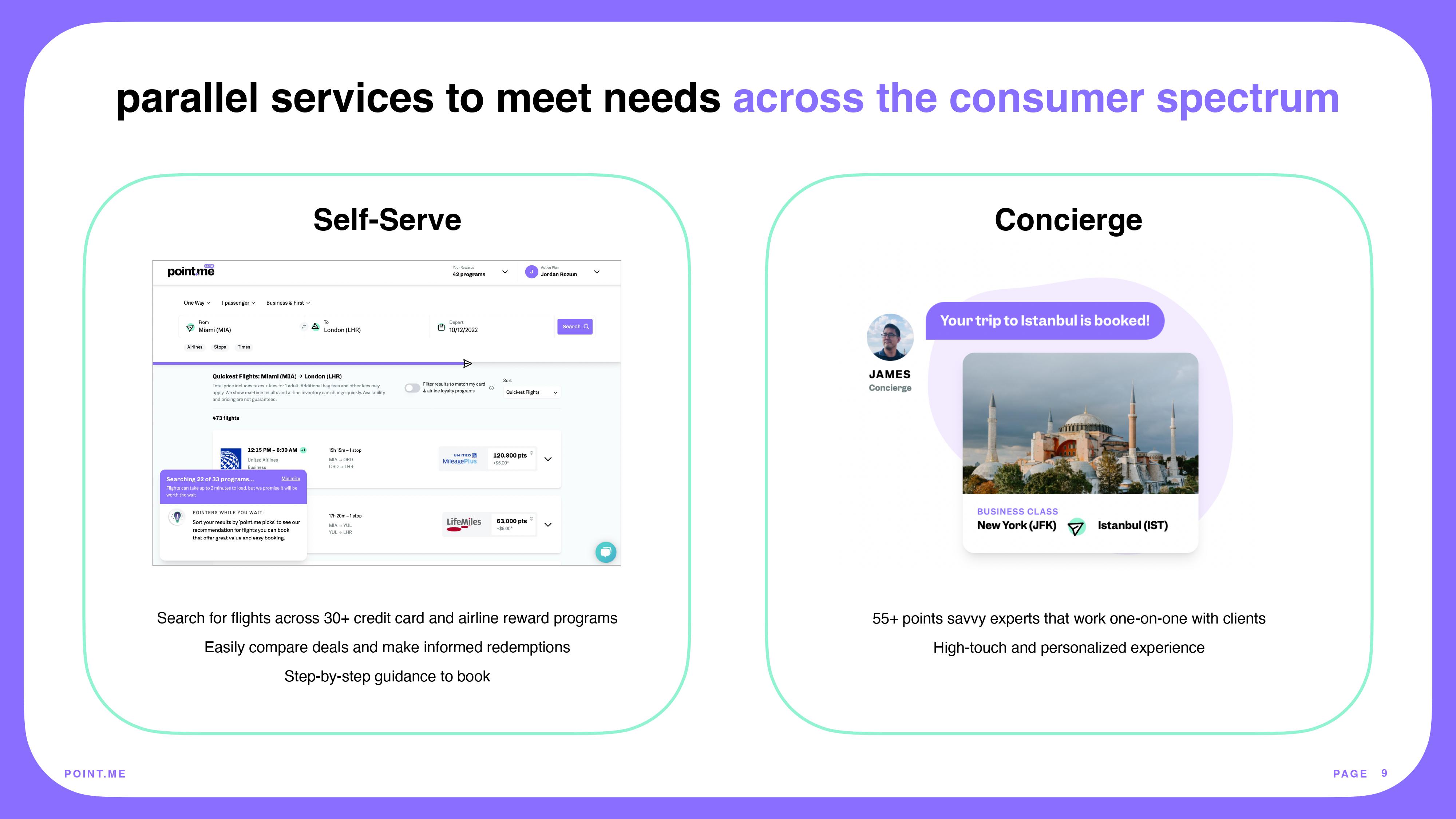

Two classes of customers

Point.me is especially useful to people who have many airline points, and such people tend to travel a lot. That makes for an interesting target audience: If you travel a bunch, it means you’re on the road often, probably for work. That means you likely have even less time than most to figure out your points situation.

This company sets itself up for success in two ways: It provides a concierge solution for people who are willing to pay a fee to have someone figure out how to make the best of their saved-up points anda self-serve platform for people who are willing to do that work themselves.

On the downside, this slide is essentially a sales slide aimed at customers. Now, many VCs do travel a lot, so I’m not giving point.me too hard of a ribbing for it, but in general, remember that the “product” you are selling to the VC isn’t the product you’re selling to your customers. A VC is interested in shares in your company, so the sales patter will be different.

In the rest of this teardown, we’ll take a look at three things point.me could have improved or done differently, along with its full pitch deck.

Three things that could be improved

Many parts of this pitch deck could be vastly improved by just removing a lot of the information, honestly. Here are a few of the things that stood out:

Are you solving a real problem?

I keep getting hung up on this company’s reason for existing, and I’m a little surprised it successfully raised a $10 million round.

One theory is that the investors saw something I can’t spot. Another is that the company got lucky and raised in a fantastically frothy market just as the pandemic was ending and lots of people were sitting on a huge cache of unspent points. Whatever the golden egg is, I just don’t see it. This is a vitamin, not a painkiller. Given the information in this deck, I’m left scratching my head.

The only thing that might have convinced me otherwise is the company’s extraordinary traction. Unfortunately, this is one of the worst traction slides I’ve seen in a hot minute.

Granted, some of the numbers are impressive (revenue of $2 million and 26,000 subscribers), but those are cumulative. The company says it has signed up26,000 subscribers, but doesn’t tell us how many of them have churned. The $2 million revenue number is great, but nowhere in the deck does it say when the company was founded. Any company can report revenue of $2 million just by sitting at a flat revenue of $200,000 per year for a decade, but no VC in their right mind would invest in such a business.

The point I’m trying to make is that traction should be graphed over time, because VCs invest in exponential growth. This slide doesn’t mention a timeline, which makes me very wary indeed.

What’s worse, a lot of the other “traction” metrics on this slide are complete fluff. “We are onboarding new partners every week.” Sure, how many? “We are partnering with one of the largest consultancies.” That sounds like future tense, so it isn’t real traction yet. “We partnered with a major card issuer.” Great, which one?

And perhaps the biggest sin on this slide: “With no marketing . . . ” That’s not a good thing. Organic growth is cheap, but it doesn’t scale very well, and if you say you aren’t doing any marketing, you risk communicating that you don’t know how to scale your business. That’s a huge red flag.

And then you have slide 12, which is anotherslide full of press quotes. I have no doubt that to a very small subset of points-loving travelers, point.me is manna from heaven, but I am stillnot sure whether this is a venture-scale business.

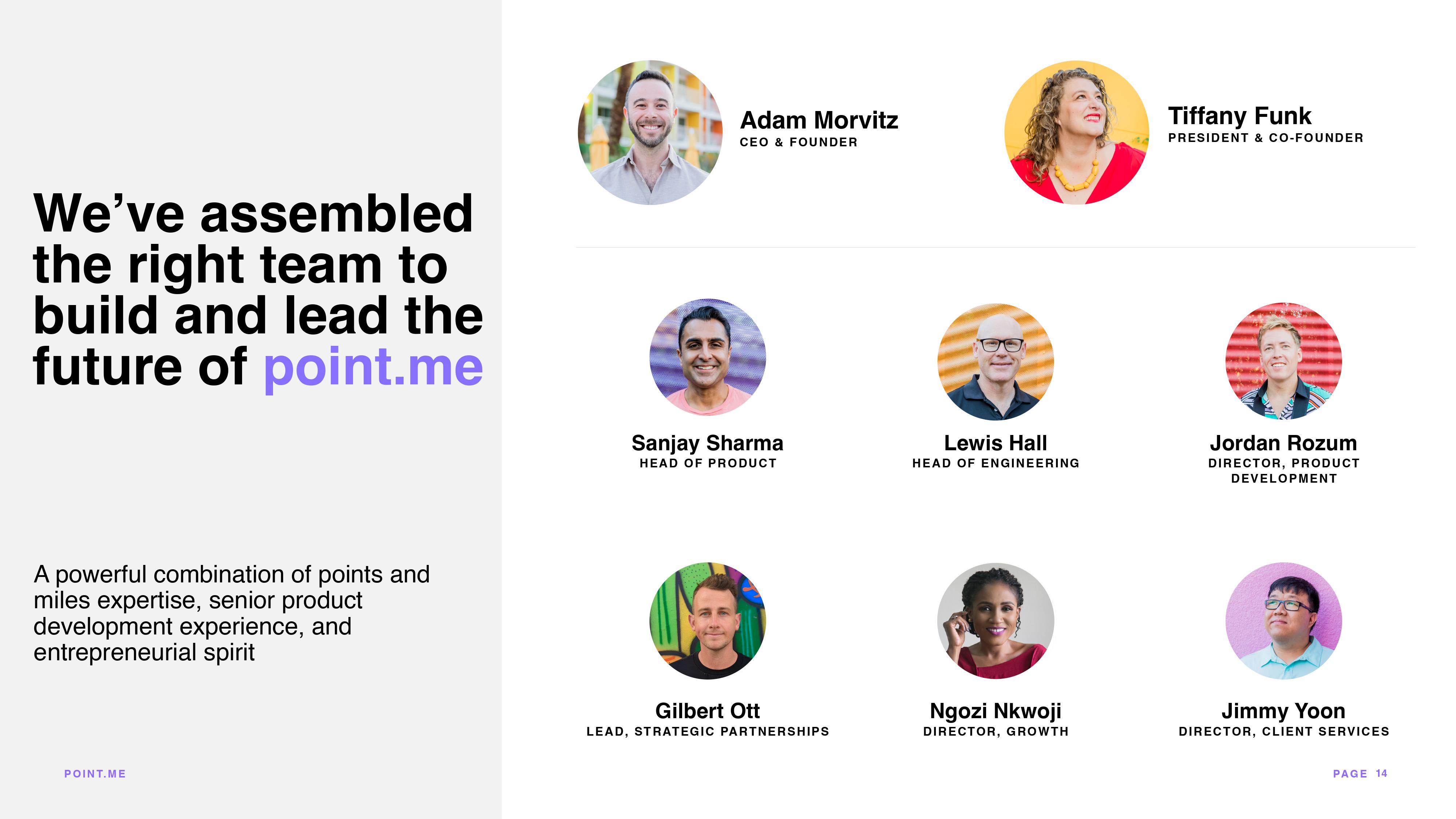

Why this team?

This is not a good slide. Even with the blurb, I don’t know which of these people have what kind of experience. Only after some light cyberstalking did I discover that the CEO has a hellof a résumé and had spent 10 years building his previous company, Juicy Miles. That’s very impressive.

Unfortunately, when I looked at that company’s page, it said, “Juicy Miles is now point.me” — that made the alarm bells that were set off by the traction slide above go from loud to deafening. The company has been running for a decade. Cumulative traction figures at a company that’s been running for a long time . . . yeah, I would have grilled the team on its traction over time.

It’s also curious that the company has a CEO anda president, because the latter is an unusual title at early-stage startups. It’s also a role that doesn’t really have a clearly defined meaning. So now I’m curious what Ms. Funk does in this company. Her résumé is alsoextraordinary, so the team evidently has great founder-market fit, but I’d like to have seen that on this slide rather than having to go look up their LinkedIn pages.

Overall, this slide gave me both unpleasant and pleasant surprises, which primarily means that it could have been designed a hell of a lot better. And once it had been improved, I’d have lobbied to feature it as slide #2. Tell the investors why this is an extraordinary team that’s well-positioned to run this company, and then tell the rest of the story. A good team is rare, so make the most of it!

What the . . .

I think what the company is trying to say here is, “Hey, we raised money from industry insiders who get what we are doing.” But it reads a little desperate to me.

Of courseyou’re going to raise your first round of institutional investment from people who know the space well. But if you’re trying to build a truly venture-scale business, I’d argue you need to raise money from investors with a lot of experience in B2C retail or consumer services.

I was also confused by the logos on the right until I realized that those are othercompanies that each of those investors have put their money in. Honestly, that doesn’t make me feel better. It means that the investors are sufficiently low-profile and/or unknown that the company is trying to associate itself with other great brands through shared investors.

The problem here, of course, is that each investor has a portfolio, and for every Getaway, Google Flights and Brex, there will be a slew of failed companies. Presumably, point.me doesn’t want to associate itself with those, so it makes little sense to include any of them here.

When I read this slide (especially in light of the other points I made earlier), I see a company that’s desperate to prove that it has traction, any traction at all and is willing to pretzel itself into some really weird shapes to prove it.

That, in itself, is a pretty significant red flag.

The full pitch deck

If you want your own pitch deck teardown featured on TC+, here’s more information. Also, check out all our Pitch Deck Teardowns and other pitching advice, all collected in one handy place for you!