Berlin-based banking startup N26 is rolling out a new stock and ETF trading feature starting with Austria as the first market. This product launch marks a renewed focus on the startup’s core markets with a larger portfolio of banking products in those countries.

Like many challenger banks, N26 started with a simple product — an account that you could use to send and receive money, and a card that you could manage in real time from a mobile app. And the company managed to convince millions of customers to open an account as it simply worked better than regular banks (banking apps usually aren’t that great).

Over time, the company expanded to more markets and started adding more products. After several years of huge funding rounds and several hiring sprees, and like many other tech companies, the company is shifting its focus to efficiency and profitability.

After opening offices in the U.S. and Brazil, N26 decided to reverse course and focus exclusively on Europe — and more specifically Germany, France, Spain and Italy.

There’s another reason why N26 doesn’t want to be spread too thin. Germany’s financial regulator BaFin started to look more closely at N26’s operations back in 2021. And BaFin still enforces a cap on client signups today. N26 can only accept 60,000 new clients a month.

“I hope that we’ll be getting out of any kind of restrictions in the next couple of quarters, but it’s very hard to predict,” N26 co-founder and CEO Valentin Stalf told me.

As a result, N26 has been ramping up its anti-money laundering controls to better comply with regulators. At the same time, the company has been trying to improve its margins and find new revenue sources for its existing customer base.

Techcrunch eventJoin 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Sequoia Capital, Elad Gil — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before Sept 26 to save up to $668.

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Sequoia Capital, Elad Gil — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before Sept 26 to save up to $668.

San Francisco | October 27-29, 2025 REGISTER NOWAfter credit and savings, N26 adds stock trading

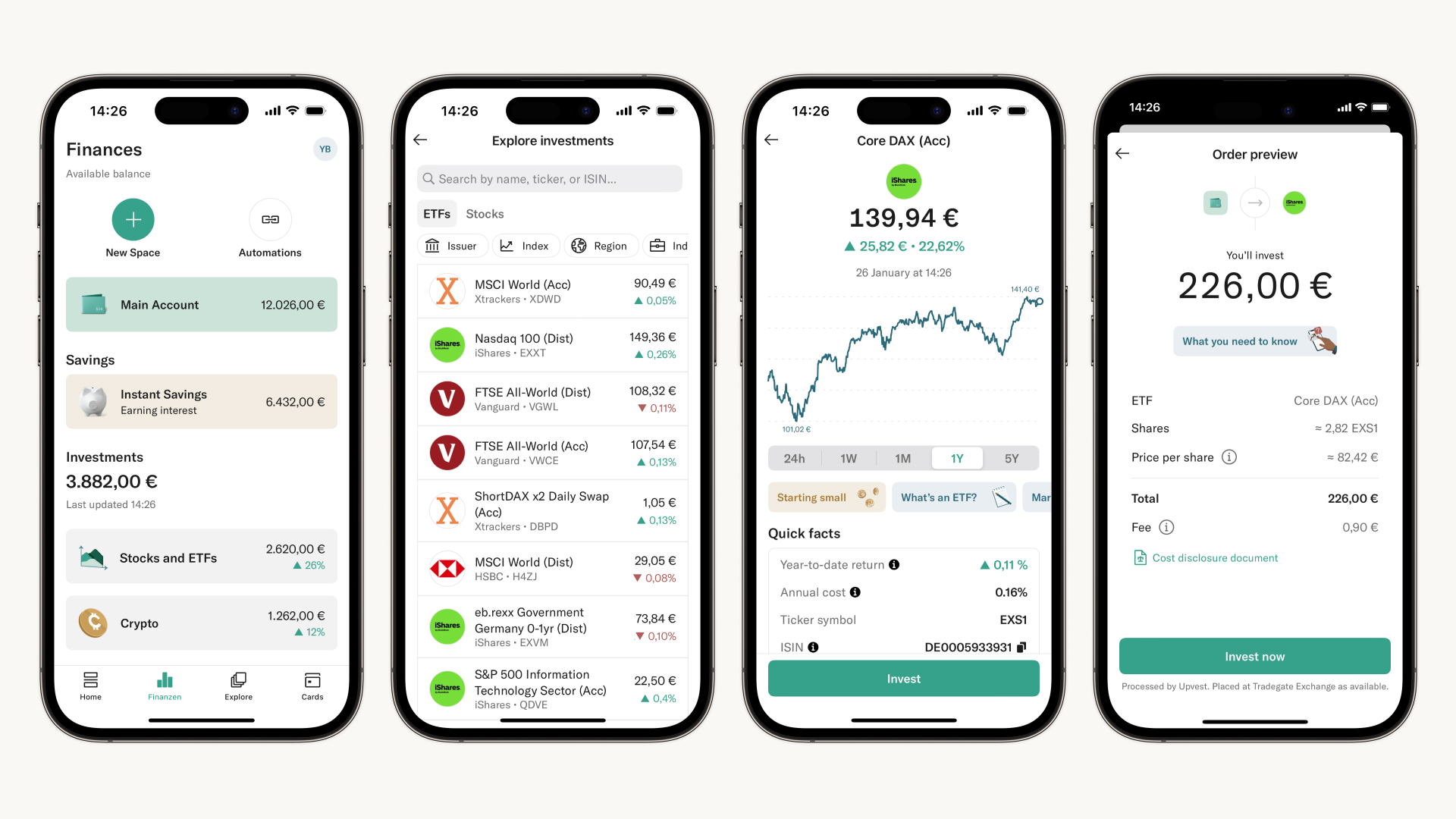

Adding stock and ETF trading is part of this strategy of increasing the average revenue per user. N26 is partnering with Upvest for this feature. Users will be able to drag and drop money from their main N26 account to this new trading space.

After that, they can choose how much money they want to invest in a particular ETF or stock. N26 supports fractional shares, meaning that users can buy a fraction of an Apple or Netflix share for as little as €1. And when it’s time to sell, users can either decide to reinvest what they got from that transaction or receive the money instantly back in their main N26 account.

N26 charges €0.90 per trade and premium customers will soon get a handful of free trades per month depending on their subscription plan. Ideally, stock trading will boost premium subscriptions as margins are very good on these subscriptions.

This is going to be a slow rollout as trading will only be available in Austria at first. It will also be limited to 100 ETFs with stocks coming later. But the company says that it will be available in Germany “in the coming months.” Other European countries will follow suit.

N26 recently rolled out savings accounts in Spain and Germany with an interest rate of 2.6% currently. Customers can also get a loan of up to €25,000 from the app. In some markets, N26 also offers crypto trading directly in the app.

In other words, N26 is slowly turning into a full-fledge bank with all the features you would expect from a bank. With stock trading, N26 competes with trading apps like Trade Republic. But N26’s main advantage is that everything is bundled in one app.

The company currently has more than 8 million customers (including 4.2 million “revenue-relevant” customers). It has €8 billion in assets under management and handles more than €110 billion in transaction volume per year.

The company sent me some (unaudited) financial data about N26’s performance in 2023. And the startup significantly increased its revenue in 2023 with more than €300 million coming from interchange fees, subscription revenue, credit products and interest revenue from customer deposits.

But the company still had a €100 million loss in 2023. That’s much better than 2022 as N26 reported a €213 million loss that year. But there’s still some work to do to reach profitability.

“By the end of last year, we were almost already break even on a monthly basis,” Stalf said. “So we continue this now. During the second half of the year, I think we’ll be profitable on a monthly basis as a full company.”