There was a brief, beautiful moment for a few months in 2021 when it felt like robotic investments might be immune from broader market forces. We all fundamentally and implicitly understood this to not be the case, but it was a nice moment nevertheless.

Truth is, there was a bit of insulation in there. There was still enough forward momentum to keep cruising for a bit, even as headwinds grew. But everything comes down to Earth eventually. Now that we’re roughly a month into 2023, we can begin assessing the damage. Looking at these graphs collated by Crunchbase, things seems fairly stark.

A couple of top line points:

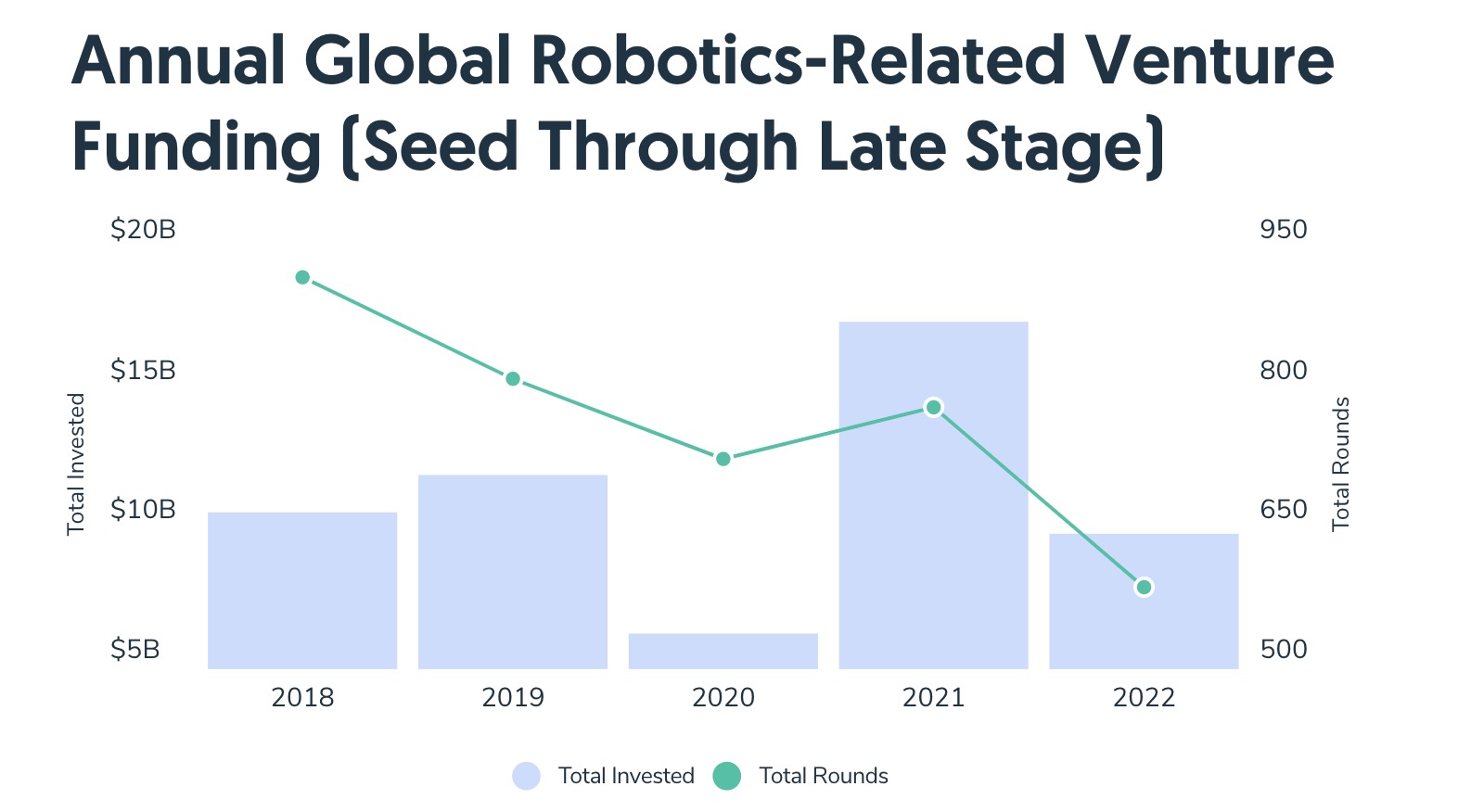

- 2022 was the second worst year for robotics investments over the past five years.

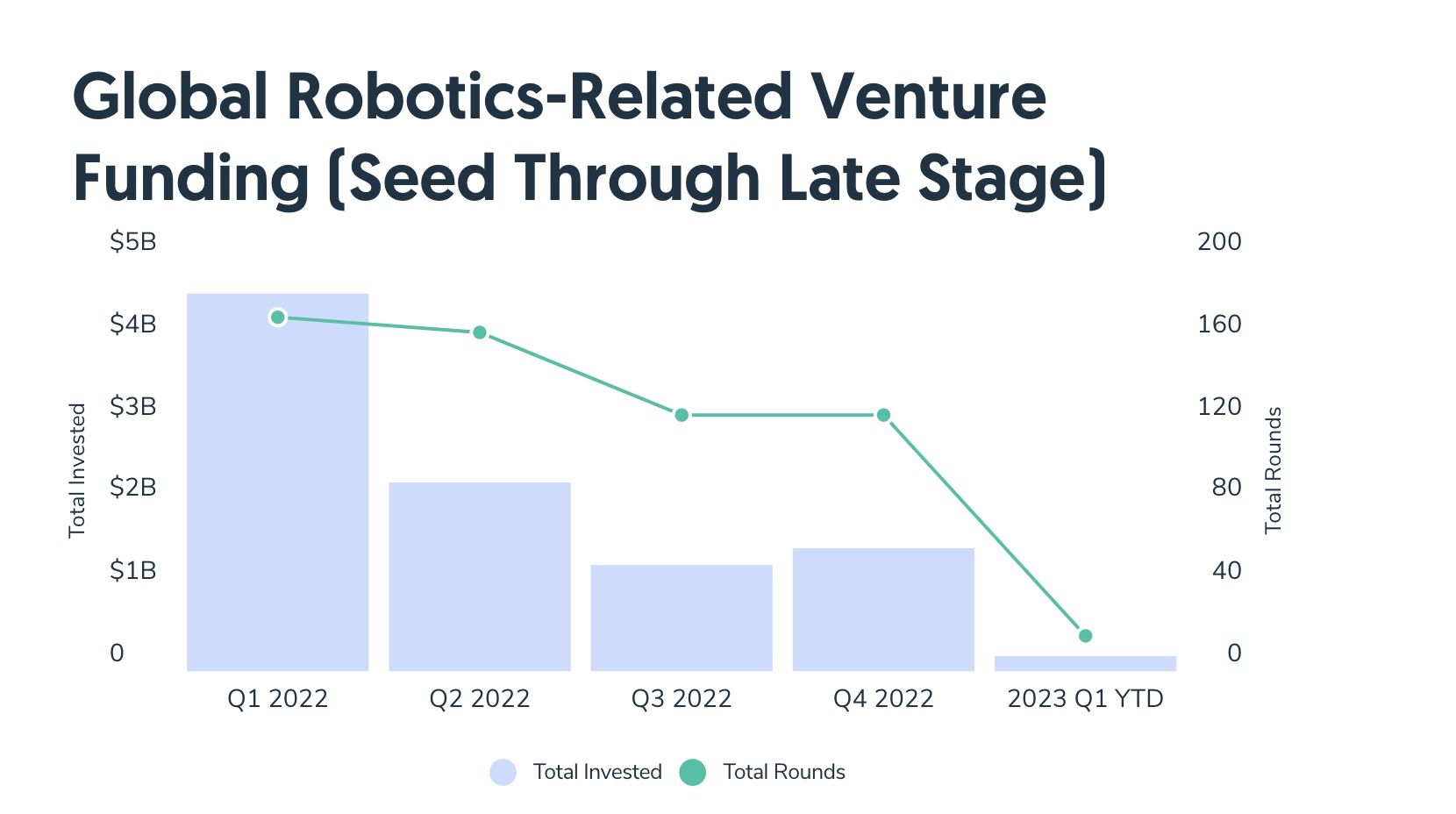

- The figures have been on a fairly steady decline for the past five quarters.

Per the first point, 2020 was the lowest. It was also an anomaly, what with the global pandemic. Uncertainty doesn’t breed investing confidence. The full year figure is even more striking given how investor confidence extended into early last year. Things really started slowing down in Q2. A cursory look at the bar graph might suggest that 2021 is an anomaly. Yes and no. Yes, as far as acceleration. No, as far as the long view. The question is not if those bars will start growing year over year, but when.

The same thing that stalled investments in 2020 accelerated them the following year. Even as things reopened, jobs were increasingly difficult to fill and companies across the board were in a desperate push to automate. As nice as it might be, we’re not ready to classify automation and robotics as “recession-proof” just yet. I do, however, suspect that those who control the purse strings fundamentally understand that these downward trends are more a product of the macroenvironment than anything specific to robotics.

For some early-stage startups, however, that’s cold comfort. A lot of runways shortened dramatically this year. Consolation could come somewhere down the road, but in a lot of cases decisive action needs to be taken for those who suddenly find themselves unable to close a round that might have felt like a foregone conclusion 12 months ago.

Given the choice between getting acquired and shutting down that some will inevitably face, it seems likely that M&A activity will spike. Sure there’s less money floating around, but few can turn down a good fire sale. In some cases, that will go a ways toward strengthening products and portfolios.

Techcrunch eventJoin 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Sequoia Capital, Elad Gil — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before Sept 26 to save up to $668.

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Sequoia Capital, Elad Gil — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before Sept 26 to save up to $668.

San Francisco | October 27-29, 2025 REGISTER NOWAnecdotally, I’m seeing investments ramp up for the year, but that appears part of the natural cycle of companies waiting until after the holidays to announce. A proper bounce back, on the other hand, seems inevitable, but only those with high-powered crystal balls can say precisely when.