In the face of recent economic downturns and fears of a startup bubble-burst, it may be surprising to hear that startups are faring better than you might think. I’ve been talking to a bunch of founders who are struggling to raise funding — and that is a real problem — but there are some startups that focus on the business fundamentals that are still thriving.

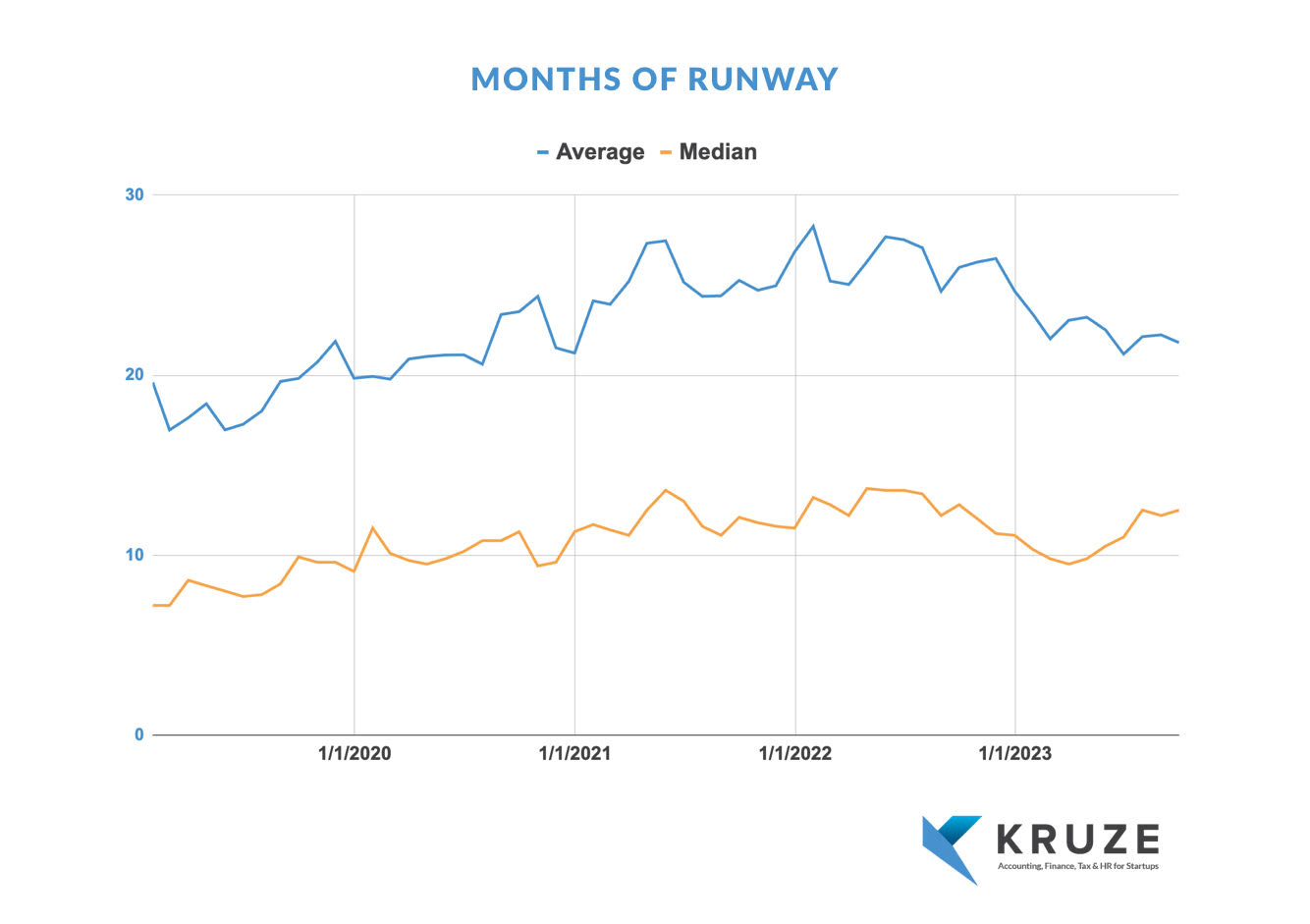

A deep dive into the data from startup accounting firm Kruze Consulting shows that startups that can keep an eye on the fundamentals — that is, those that are running more like a “real” business, rather than the “growth at all costs” mentality we’ve seen over the last few years — are in pretty decent shape. Looking at the numbers, this presents as an uptick in median runway length, a decrease in operating expenses, and an encouraging rise in profitable revenue.

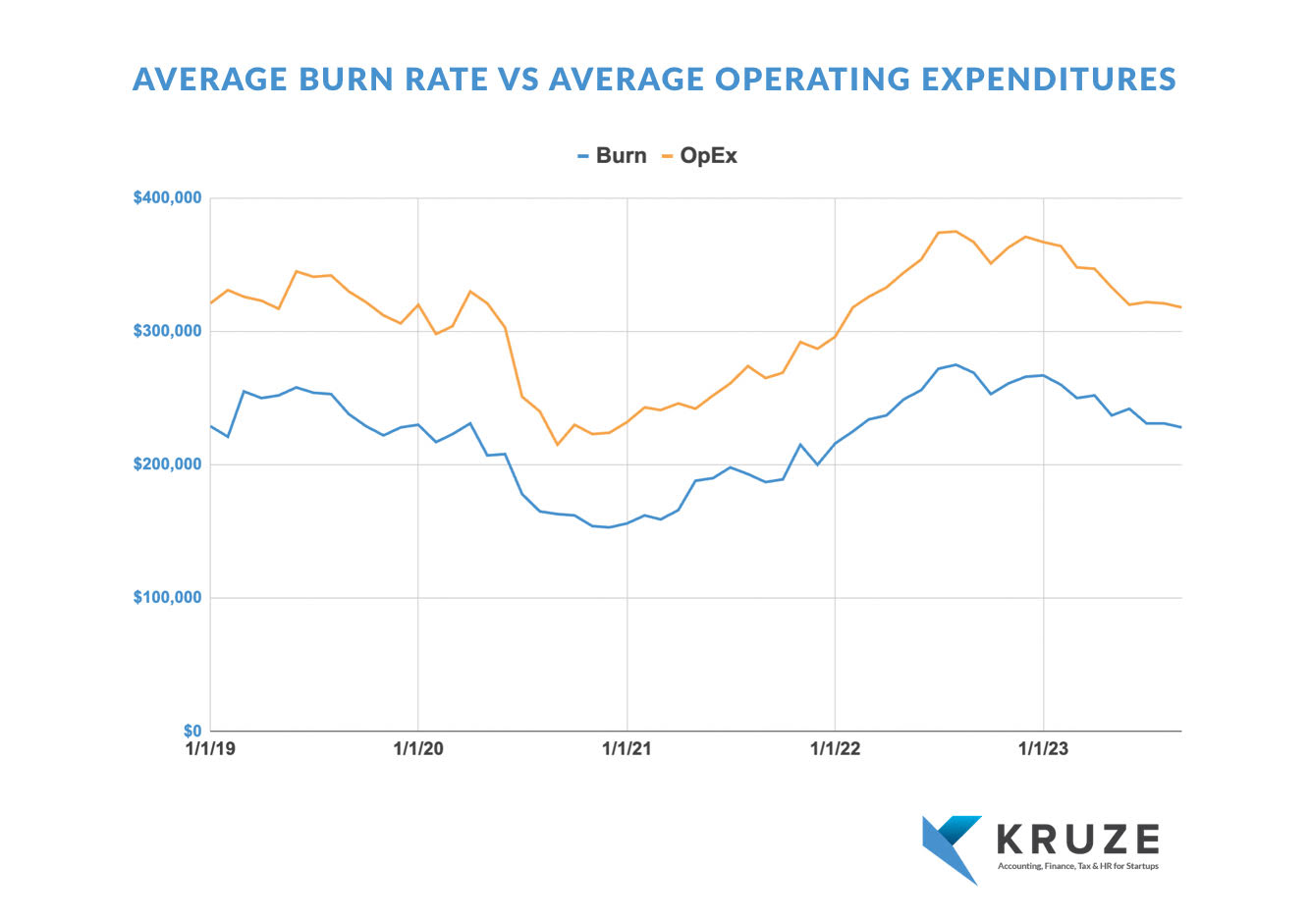

“The average burn is coming down this year, driven by lower OpEx spending. This is founders focusing on being more efficient,” Healy Jones, VP of financial strategy at Kruze Consulting, told me. “Of course, a lot of this is driven by the layoffs that have made headlines (so not a happy thing to brag about), but on the other hand, the founders are learning how to be more effective in using their cash, which is a good thing for the ecosystem.”

The median startup runway, which is the estimated amount of time a company can operate until it runs out of cash, has actually increased in the second half of 2023. It now stands at an impressive 12.5 months, significantly higher than the nine to 10 months usually expected after an average funding round.

This is due to several factors. While fundraising has proven challenging, companies displaying strong performance have found success and continue to raise funding. Zooming out a little, this demonstrates that the VC investors remain open to promising ventures and that venture capitalists are still investing.

The other side of the same coin is that companies have reduced their burn rate, resulting in a more efficient use of funds. Lastly, many companies with limited cash have unfortunately had to close their doors. Ironically, that, too, raises the median runway: Obviously, it’s the companies with the shortestrunway that disappear soonest.

Techcrunch eventJoin 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Sequoia Capital, Elad Gil — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before Sept 26 to save up to $668.

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Sequoia Capital, Elad Gil — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before Sept 26 to save up to $668.

San Francisco | October 27-29, 2025 REGISTER NOW

A closer look at OpEx and burn rates also reveals interesting trends. The widening gap between these two metrics essentially indicates growing revenue or gross profit. This is a positive sign that companies are focusing on creating profitable revenue, a significant improvement from 2021. The burn rate has also decreased this year, primarily due to a reduction in OpEx, a testament to the increased efficiency of the founders.

Obviously, the decrease in burn rate is not without its casualties. The layoffs that have dominated the headlines in recent months have contributed to this reduction in OpEx. Yet, it also indicates that founders are learning to use their resources more effectively, a necessary skill for survival in this competitive environment.

Cash balances are also holding steady. The spike caused by significant funding rounds in 2021 and 2022 has normalized, but the average remains high by historical standards. More importantly, the median has increased this year, a trend that is reflective of the reasons behind the increased runway length.

In sum, the startup ecosystem is showing signs of resilience and adaptability. Founders are focusing on generating profitable revenue and being more efficient with their spending. While the headlines may focus on the layoffs and closures, these data points paint a picture of an ecosystem that is surviving, and in some ways, thriving amid adversity.

The dataset Kruze talked me through includes numbers from more than 800 startups, and data covering more than five years.

It’s clear that while startups face significant challenges, many are finding ways to adapt and persevere. It’s an important reminder that even in times of economic uncertainty, innovation and persistence can still pave the way for success — for startup founders, for VCs, and for the broader ecosystem as a whole.