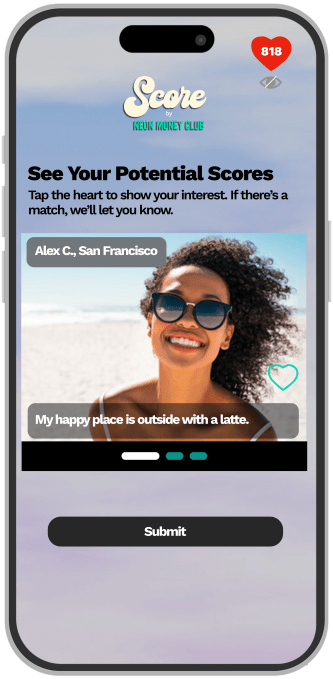

There is a new dating app just in time for Valentine’s Day, but there’s a catch: You must have at least a 675 credit score to use it. Launched today by financial platform Neon Money Club, Score is a dating app for people with good to excellent credit, and it seeks to help raise awareness about the importance of finances in relationships.

“We need to take the conversation to areas where finance isn’t traditionally discussed,” Luke Bailey, co-founder and CEO of Neon Money Club, told TechCrunch, adding that traditional methods of raising financial awareness are outdated. “Before you can educate people, you need to get their attention. With Score, we’re bringing the conversation to dating.”

Talking about money is often uncomfortable, but the reality is that finances can be an important part of relationships for a lot of people. According to CNBC, most U.S. citizens believe debt is a solid reason for a divorce. Indeed, financial issues are one of the leading causes of divorce in this country.

The idea for the app was conceived at last year’s AfroTech. Neon Money Club was already looking for a way to address credit health, and it threw a party that saw hundreds of people flood the streets of Downtown Austin. As people lined up, Bailey and his team started to ponder what they could ask these partygoers that would make them feel comfortable talking about finances.

“We decided to ask one question: ‘What should the minimum credit score be for someone you’re dating?” Bailey said. “That question later became Score.”

The app will only be available for a limited time (around 90 days), and prospective users must apply to get access. On signing up, Neon Money Club will do a soft credit check on users that will not impact their credit reports, and the score will not be displayed on the app, Bailey said. If approved, users will have access to financially like-minded people on the app. People are also not matched based on credit tiers, so someone with a score of 700 can match with someone who has a score of 800. From there, it’s swipe left or right as usual.

The exclusionary aspect of the app is no doubt going to rub some people the wrong way, especially when you consider that the average U.S. citizen’s credit score is 716, with Black and Hispanic people more likely than other racial groups to have a score below 640. When asked about how people could perceive the app as perpetrating the class divide, Bailey said that having good credit is more aspirational than it is classist. He also pointed out that it’s completely possible to have a high income with low credit. Those denied access to Score will be sent to resources to improve their financial literacy and to credit builder Grow Credit to help them boost their credit scores, he said. “Afterwards, those people are sent back to us to qualify for our products,” Bailey said, adding that it’s an intentionally positive cycle. “There needs to be more awareness about the doors that can be opened with a good credit history.”

Techcrunch eventJoin 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Sequoia Capital, Elad Gil — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before Sept 26 to save up to $668.

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Sequoia Capital, Elad Gil — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before Sept 26 to save up to $668.

San Francisco | October 27-29, 2025 REGISTER NOWNeon Money Club launched in 2021 with the aim of tracking financial literacy, and last year became the first Black-owned tech business to launch a credit card with AMEX. The card allows people to convert credit card points into cash that they can then invest in the stock market.

The company has raised more than $10 million in venture capital, according to PitchBook.

“We need more creative and diverse voices in the world of finance,” Bailey said. “We aren’t the only people who think like this. The industry just needs to open more doors for others like us.”